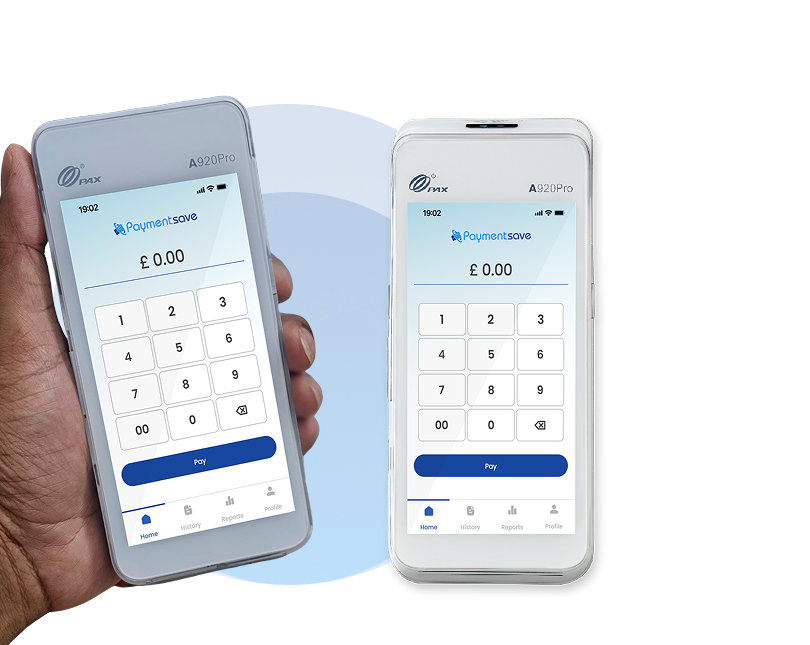

Mobile Card Machine

Make your business simple with mobile card machine take payment from on the road or anyplace, anytime anywhere. Boost your sales now.

Low Transaction Fees

Next-Day Settlement

24/7 Customer Support

Mobile card machines

Make your business simple with mobile card machine take payment from on the road or anyplace, anytime anywhere. Boost your sales now.

Low Transaction Fees

Next-Day Settlement

24/7 Customer Support

Why Choose Mobile Card Machine for Your business Growth?

Paymentsave has years of experience providing countertop card machines for businesses of all sizes. Our clients rate us 5 stars with 100% satisfaction. We prioritize supporting your business with reliable, affordable solutions. Countertop card machines are a cost-effective way to process credit, debit, and EBT card payments, offering flexible options for various transaction needs.

Accept Payments Anywhere: Get paid from your customers anytime, anywhere.

Encourage More Spending: With easy payment options, customers are more likely to buy.

Low-Cost Option: Mobile card machines are more affordable compared to countertop or portable options.

What is Mobile Card Machine?

A mobile card machine is a device that allows you to take payments from your till or outside your shop, restaurant, bar, beauty salon, or any business location using a 3G or 4G connection. This machine connects via a SIM card, so there’s no need for WiFi, Ethernet, or a direct line to accept payments. With a mobile card machine, you can accept all types of payments (credit cards, MasterCard, Visa, Google Pay, and digital wallets) from your customers, with no limitations on their location.

How do mobile card machines work?

The mobile card machine has a 3G / 4G SIM and this machine runs on battery and does not need any wires and it is connected to the mobile network.

When a user puts his card on these tools, this machine reads the data and processes the payment with the card issuing bank and the payment is done easily after verification.

Features of Mobile Card Machine?

Mobile card machines are light and easy to carry, letting businesses take payments anywhere with a cell signal or Wi-Fi, which is great for businesses on the move or at events. They allow contactless payments, like tapping cards or scanning QR codes, making transactions fast and easy. With strong security features like encryption, they keep payment information safe and lower the risk of fraud. Some mobile card machines also work with POS systems and accounting software, making it easier to manage transactions and keep track of finances.

Benefits of Mobile Card Machine?

Here is the benefits for your business which can helps you to grow business to next level.

Easier payments mean more sales.

Save on traditional POS system expenses like hardware and fees.

Works for businesses of any size

Accept payments anywhere, offering flexibility in all locations.

Businesses That Must Have Mobile Card Machines

Food Trucks

Mobile food vendors often move from one location to another, making portable card machines essential for accepting payments wherever they go.

Event Vendors

Whether it’s at festivals, markets, or conferences, vendors at events need portable card machines to facilitate transactions with attendees who may not have cash on hand.

Delivery Services

Delivery businesses, such as restaurants offering food delivery or courier services, rely on portable card machines to accept payments upon delivery at various locations.

Home Services

Professionals providing services like plumbing, electrical work, or landscaping can benefit from portable card machines to accept payments on-site from clients.

Taxi & Ride-Hailing Services

Taxi drivers and drivers for ride-hailing services like Uber or Lyft often use portable card machines to accept fares from passengers without cash.

Tour Guides

Tour operators and guides who conduct tours in different locations can use portable card machines to collect payments from participants.

Mobile Card Machine Encouraging customers to spend more.

Due to the easy payment gateway, customers do not always have problems when making payments which makes them willing to shop without any worries.

And since the limit of this contactless payment is $ 30 to $ 50, the customer is spending 29% on average contactless payment.

How to get a mobile card machine for your business?

Paymentsave stands out in the market for its transparent pricing and low transaction

fees, ensuring you keep more of your profits. Here’s how Paymentsave compares:

Get your free quote

Whether you’re a retail store, restaurant, or mobile service, our tailored payment solutions fit your unique needs.

Get Setup in 3 days

Our expert team will set up

your countertop machine within 3 days, ensuring zero errors and 100% security.

Fast Payment

Payments are transferred the next working day with simple sales reports to help you manage your shop effectively.

Our Support Team is Always Ready to Help your Business 24/7

Immediate Assistance

Our support team is available round the clock, ensuring prompt responses to any inquiries or issues your business may encounter.

Expert Guidance

Receive expert guidance and solutions tailored to your business needs, whether it's technical assistance, account management, or troubleshooting.

Accessibility

Our support channels are easily accessible via phone, email, live chat, or online ticketing system, ensuring convenience and responsiveness whenever you need assistance.

How Does Paymentsave Compare in Pricing?

Paymentsave stands out in the market for its transparent pricing and low transaction

fees, ensuring you keep more of your profits. Here’s how Paymentsave compares:

Lowest transaction fees

Paymentsave offers some of the most competitive transaction fees in the UK, with savings of up to 40% compared to many competitors. This means your business can process payments at a lower cost, helping to improve your overall profitability.

No Hidden Costs

Unlike some providers that charge unexpected fees, Paymentsave provides upfront pricing with no hidden fees. You’ll know exactly what you’re paying for, making budgeting and financial planning easier for your business.

Flexible Options Business

Paymentsave ensures that all

transactions processed through our

card machines are PCI DSS

(Payment Card Industry

Data Security Standard) compliant.

This industry-standard protocol

protects cardholder data and reduces

the risk of security breaches.

No Upfront Cancellation Fees

Paymentsave ensures transparency by offering no upfront cancellation fees, giving you more flexibility to adjust your payment processing solutions if your business needs change.

Review from our happy client

Great service and huge savings Steve gave me compared to my old provider, excellent onsite service including integration…

Rio Deli

Great service and huge savings Steve gave me compared to my old provider, excellent onsite service including integration…

Marzan Ahmed

Very good customer service from mamun Very good customer service from mamun

shan anushan

was very friendly and very patient and taught me all the features of the card machine slowly and was understanding…

thirsa thevaraj

I’m using payments average card terminal nearly 3/4 years, I’m very happy about that.Especially Anwar help me lots, I know him nearly 6years,he is a good man, Recommend Anwar & payentsave.

Baig Asghar

Since I started using paymentsave I found my business card payment so much safe. Never had any issue. You must try. Thank you kazi

Sima Veardi Monfared

Ready to transform your payment experience?

FAQs

How much does a mobile card machine cost?

The cost can vary depending on your provider and plan, but at Paymentsave, we offer competitive pricing with no hidden fees. You can even get started with no upfront cost—just request a free quote and we’ll give you a clear idea of the price based on your business needs.

What types of payments can I accept with a mobile card machine?

You can accept all major card types including Visa, Mastercard, American Express, UnionPay, and digital wallets like Apple Pay and Google Pay. Whether it’s contactless or chip & pin, your mobile card machine has you covered.

How do I connect my mobile card machine to my till?

You don’t need to connect it to a till at all! A mobile card machine works on 3G/4G with a SIM card, so it’s completely wireless. That means you can take payments on the go—no Wi-Fi or Ethernet required.

How do I choose the right card machine for my business?

It depends on how you operate. If you’re always on the move (like a delivery service or market vendor), a mobile card machine is perfect. If you’re based at a single location, a countertop machine might suit you better. Our team is happy to help you pick the best option just reach out for a free consultation.