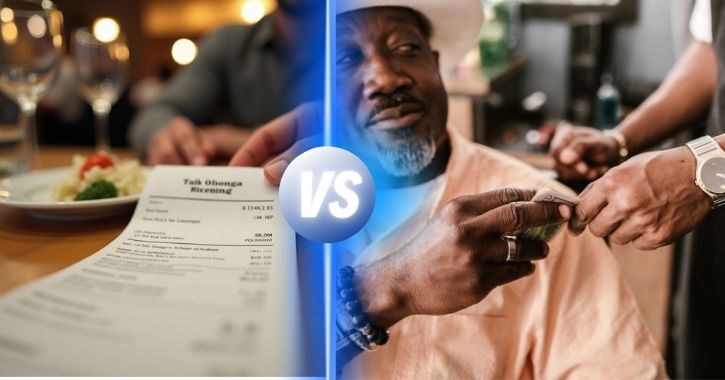

Tips and service charges are both extra payments for service, but they’re not the same.

A tip is voluntary and given directly to staff, while a service charge is a mandatory fee added by the business, often shared among employees or kept by management.

What Is a Tip?

A tip, also known as a gratuity, is a voluntary payment that customers give to staff members as a token of appreciation for good service. Unlike service charges, tips are not automatically added to the bill the customer decides whether to leave one and how much to give, typically based on the quality of service received.

In most cases, the tip is handed directly to the person who provided the service, such as a waiter, taxi driver, or hairdresser. This means the individual who worked with the customer receives the full amount of the tip as a personal reward. The amount can vary, but it’s common for people to leave between 10% and 20% of the total bill.

Tipping is widely practiced in industries like restaurants, beauty salons, hotels, and transportation, where personal service is a key part of the customer experience.

What Is a Service Charge?

A service charge is a mandatory fee added to a customer’s bill by a business, usually to cover the cost of service provided by staff. Unlike tips, this charge is not optional — it’s automatically included in the final amount you pay and is clearly listed on the receipt.

Businesses typically apply a service charge in industries like hospitality, events, and catering, where multiple staff members contribute to the overall service. The amount is usually set as a percentage of the total bill, often around 10% to 15%.

The money collected through a service charge doesn’t always go directly to the person who served you. Instead, it may be shared among staff, managed by the business, or used to support wages and operational costs. In many cases, the business decides how the service charge is distributed.

Service charges are also handled differently when it comes to tax and accounting. Since they are considered part of the business’s income, they are subject to VAT or sales tax and reported accordingly.

Key Differences Between Tips and Service Charges

While tips and service charges may seem similar, they differ in several important ways — especially in terms of how they’re applied, who receives them, and how they’re taxed.

A tip is always voluntary. The customer decides whether to leave one and how much to give, often based on the quality of service. It is usually handed directly to the staff member who served the customer, such as a waiter, driver, or hairdresser. Tips are not itemised on the bill and are generally considered the personal income of the employee — although they may still need to be declared for tax purposes.

In contrast, a service charge is mandatory. It is automatically added to the final bill by the business and clearly listed as a separate line item. Unlike a tip, the service charge may not go directly to the individual who served you. It can be pooled among staff, distributed according to company policy, or retained entirely by the business. For tax purposes, service charges are treated as business income and are subject to VAT or other applicable taxes.

Here’s a side-by-side comparison to make the differences clearer:

| Aspect | Tip | Service Charge |

| Voluntary? | Yes | No |

| Who receives it? | Usually the employee directly | Business decides (individual, pooled, or retained) |

| Shown on the bill? | No (left separately by customer) | Yes (automatically itemised) |

| Tax treatment | May need to be declared by employee | Counted as business income and taxed |

| Who sets the amount? | Customer | Business |

Are Tips and Service Charges Taxed Differently?

Yes – and the difference matters.

Let’s break it down:

Tips Are Treated as Employee Income

When a customer leaves a tip, it’s considered personal income for the employee.

That means:

- The employee is responsible for declaring it to HMRC (UK) or IRS (US)

- In most cases, tips must be taxed like any other income

- If tips are shared (like pooled tips or tronc schemes in the UK), the tax treatment may vary but it’s still income

So even though a tip feels like a thank-you gesture, the government sees it as taxable money.

Service Charges Are Business Revenue

Here’s where things change.

A service charge is classified as business income — not a personal gift or reward.

That means:

- The full amount is usually subject to VAT (UK) or sales tax (US)

- The business decides whether to distribute it to staff, pool it, or keep it

- It must be recorded in company accounts as part of gross revenue

In short, service charges are treated like any other sale the business makes.

Do You Have to Tip if There’s a Service Charge?

No, you are not required to tip if a service charge is already included on your bill.

When a restaurant, hotel, or other business adds a service charge, it’s meant to cover the cost of the service provided by staff. This charge is usually a percentage of your total bill and is clearly stated on your receipt. Since the business has already included a fee for service, there’s no expectation for you to leave an additional tip.

However, some customers still choose to leave a small extra tip especially when the service has been outstanding. This extra tip is completely optional and usually given as a personal gesture of appreciation to the staff member.

In short, if you see a service charge on your bill, tipping isn’t necessary. But if you genuinely want to thank your server for going the extra mile, you can still tip it’s entirely up to you.

Why Do Businesses Use a Service Charge?

Businesses use a service charge for several important reasons and it’s not just about convenience.

One of the main reasons is to help ensure fair wages for staff. Instead of relying solely on tips, which can be inconsistent, a service charge allows employers to provide a more stable income for their team.

It also gives the business more control over how service-related income is distributed. In many workplaces, service charges are pooled and then shared among front-of-house and back-of-house staff, ensuring that everyone involved in delivering the customer experience is rewarded not just servers.

Another benefit is that service charges help simplify payment processing. Since the fee is automatically added to the bill, customers don’t need to calculate a tip, and staff don’t need to handle cash or track individual tips.

Finally, in some regions, service charges help businesses comply with local wage laws or minimum income requirements. This is especially common in countries where tipping isn’t a cultural norm or where the law requires guaranteed service income.

In short, service charges offer structure and transparency both for businesses and their employees.

Frequently Asked Questions About Tips and Service Charges

Is it rude not to tip?

No, it’s not rude if a service charge is already included in the bill. In places where a service charge is added automatically, there’s no obligation to leave an extra tip. However, in countries or businesses where tipping is the norm and no service charge is applied, not tipping may be considered poor etiquette especially in service-based industries like restaurants, salons, and taxis.

Can a business keep the service charge?

Yes, a business can legally keep or control how the service charge is distributed. In many countries, service charges are treated as company revenue. That means the business can choose to keep it, share it among staff, or use it to cover operating costs — unless specific local laws require transparency or mandate that service charges go directly to employees.

Should I tip on top of a service charge?

Tipping on top of a service charge is not required. The service charge is meant to cover the cost of service. However, if you feel the service was outstanding, you’re welcome to leave an additional tip as a personal gesture. It’s entirely optional and based on your experience.